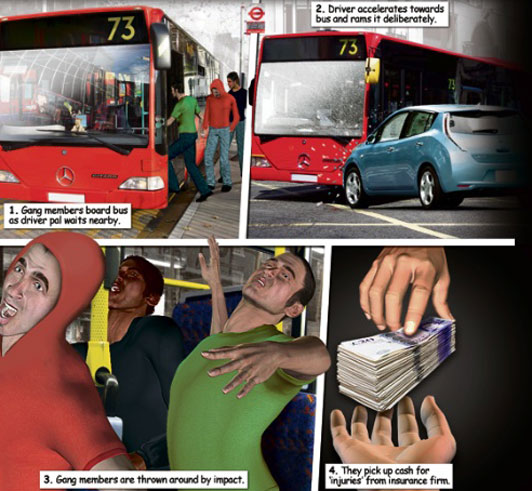

Deaths due to fake crashes staged to make insurance claims

In a shocking statement, the global head of Aviva said that some of their customers have died as a direct result of fake crashes staged to make insurance claims.

While in Dublin last week, head of Aviva, Mark Wilson, who is from New Zealand, said that whiplash fraud in Ireland is a "national disgrace". To counteract this, Aviva has given their Irish managers unlimited budgets to fight any suspected fraudulent claims in the courts. In the four years, he has been head of Aviva, he has led a major campaign against insurance fraud.

"I went to the team and said 'You have no limit on your budget, take every case you think is fraud to protect our consumers,"

"What we said was we don't care about the cost - whatever cost, take it. Destroy the fraudsters and the crooked lawyers who back them," he said.

"I want to be ruthless on fraud and pay out genuine claims - that's the point.

"In the UK and here you have criminal elements setting up 'crash for cash'. And we have had some of our customers killed in cash for crash.

"It is a national scandal, it is bad for Ireland and it is terrible for the consumer, because you know what, we [Aviva] don't pay for it, the consumer pays for it."

Aviva is also looking for new legislation which would reduce the size of payouts for whiplash and other claims. They claim that this will help bring down motor insurance costs.

"This market for a long time has had irrational behaviour...In a post-Brexit world, Ireland needs to be seen as safe and secure, and you cannot be seen as safe and secure if your insurance companies keep on getting into trouble,".

Aviva is Ireland's biggest insurer, employing more than 1,000 staff. The Irish branch of Aviva is regulated in the UK and operates in Ireland as part of the European Single Market. With Britain set to leave the European Union, Aviva has begun the process for its Irish business to be a stand-alone subsidiary, regulated by the Central Bank of Ireland.

[caption id="attachment_1705" align="alignnone" width="300"]

[maxbutton id="1"]

Author

Justin Kavanagh

Justin Kavanagh is a recognised leader

in automotive intelligence and vehicle

data supply to the entire motor industry.

He has almost 20 years experience in

building systems from the ground up.

As the Managing Director of Vehicle

Management System, he understands the

need and importance of trustworthy and

reliable vehicle history and advice to

both the trade and the public.

Follow me on LinkedIn